Overview

The Dauch College of Business and Economics recognizes that the learning outcomes of the education process are extremely important. Our approach to student learning outcomes assessment follows a continuous improvement model, with an evolving set of outcomes and assessments as we react to the needs of our stakeholders and refine our data collection and analysis procedures.

Our outcomes assessment program began in the mid-1990s, with the identification of key variables to be measured and tracked as part of a competency framework adopted by the College. The competencies were selected based on input and feedback collected from various stakeholders, including current and potential employers of our graduates and members of our Business Advisory Council. The seven student learning outcome content areas to be assessed at the College level include:

- Communication Skills: Graduates of business programs communicate correctly and purposefully, integrating technology into writing and presentation.

- Critical Thinking: Graduates of business programs identify problems, analyze information and form conclusions within the business context.

- Business Knowledge and Technical Skills: Graduates of business programs demonstrate knowledge from a variety of sub-disciplines and apply the knowledge and skills to reach solutions to business needs.

- Leadership / Team Skills: Graduates of business programs inspire a shared vision, foster a realization of that vision and facilitate a culture to realize goals of the vision.

- Ethics: Graduates of business programs understand the ethical behaviors and issues relevant to the business community.

- Analytical / Quantitative Skills: Graduates of business programs possess analytical/quantitative skills appropriate to the business community.

- International and Global Perspective: Graduates of business programs have an international and global perspective appropriate to a progressive business community that engages in international business activities.

Student learning outcomes for all seven competencies are assessed through course-embedded assessments administered and evaluated by faculty members and monitored for program assessment purposes. External and authentic outcome assessments also are performed using a variety of methods. The remainder of this summary provides more details on several key assessments. The first of these is the Educational Testing Service (ETS) Major Field Test, administered to all graduating seniors during a required Senior Assessment class. The second is an assessment of specific outcomes evaluated by supervisors (employers) of undergraduate student interns. The third is a program-specific assessment: the performance of student members of the Eagle Investment Group as they actively manage more than $2 million of the University’s endowment. The fourth also is a program-specific assessment: using the VITA tax program exams along with the percentage of rejected/errored tax returns prepared by a student in the undergraduate Accounting program.

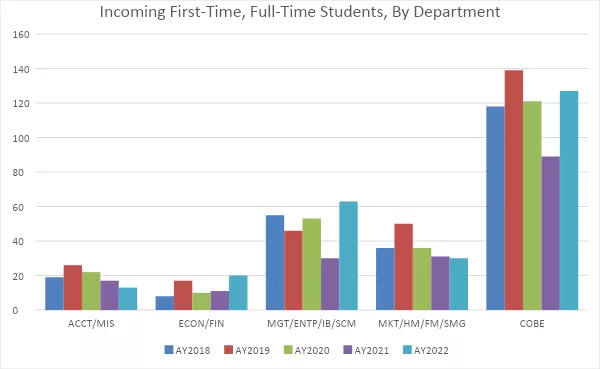

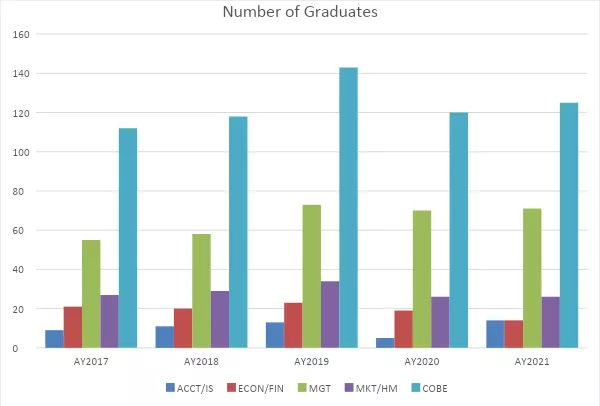

In addition to the student learning outcome assessment data provided here, we also show program effectiveness data, including the tracking of enrollment data for first-time, full-time students by department and five-year graduation rates by department. These charts can be found at the end of this document.

ETS Major Field Test (Undergraduate)

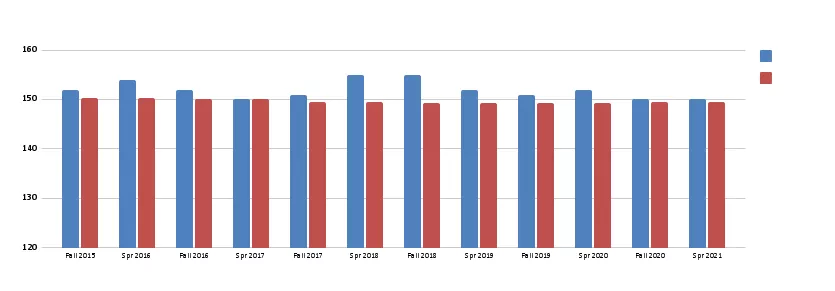

Many institutions use the ETS Major Field Test for students receiving a Bachelor’s Degree in Business as an end-of-program student learning outcomes assessment instrument. The test itself is a multiple-choice test “designed to measure a student’s subject knowledge and the ability to apply facts, concepts, theories and analytical methods.” [ETS website] The Dauch College of Business and Economics has administered this test as a key summative assessment for undergraduate COBE programs. The test is given to students taking the BUS499 Senior Assessment class. In addition to an overall score, the mean percent correct for all students taking the exam is calculated for each of nine specific assessment indicators. Comparative data tables provided by the ETS enable comparisons with other institutions using the test. The following chart shows the relationship between the Dauch College of Business and Economics (COBE) overall mean score for all students taking the exam and the mean score for students with senior status at all domestic institutions for one or more years prior to the test semester.

ETS Major Field Test Mean Scores, COBE vs. National Average

ETS Major Field Test Mean COBE Scores and Corresponding Percentile

| Semester | Mean Program Score | Percentile |

|---|---|---|

| Fall 2015 | 152 | 53 |

| Spring 2016 | 154 | 66 |

| Fall 2016 | 152 | 56 |

| Spring 2017 | 150 | 43 |

| Fall 2017 | 151 | 50 |

| Spring 2018 | 155 | 78 |

| Fall 2018 | 155 | 78 |

| Spring 2019 | 152 | 61 |

| Fall 2019 | 151 | 53 |

| Spring 2020 | 152 | 61 |

| Fall 2020 | 150 | 46 |

| Spring 2021 | 150 | 46 |

Although COBE performance was above the national average for the three semesters between fall 2015 and fall 2016, it fell below the national average for the spring 2017 group. From fall 2017 to spring 2020, we have remained at or above the national average. During the fall 2020 and spring 2021 semesters, although our scores were consistent, they were below the national average. While our international student population has declined within the most recent four years, we continue to work with both domestic and international student populations to improve learning outcomes and experiences. Overall COBE performance has been consistent at or above the 50th percentile fifteen of the last twenty semesters. Though we can’t say for sure, performance also may have declined because of the disruptions and distractions caused by COVID-19.

Action taken: Performance outcomes are discussed at our COBE leadership team meetings and department meetings, and faculty are being encouraged by their department chairs to find ways to better engage international students and domestic students in class, to improve the students’ learning of specialized business knowledge. In summary, we conclude that our students have performed at or above the national average for the past twelve years, including above the national average in nine of the past twelve semesters.

We rated this level of performance as exceeding expectations. Faculty members in each functional area review the results and discuss whether curriculum changes are warranted, “closing the loop” and completing our assessment process. Overall, we are satisfied with the performance of our students on this external assessment of their business knowledge and technical skills, and we would rate our students as meeting or exceeding expectations.

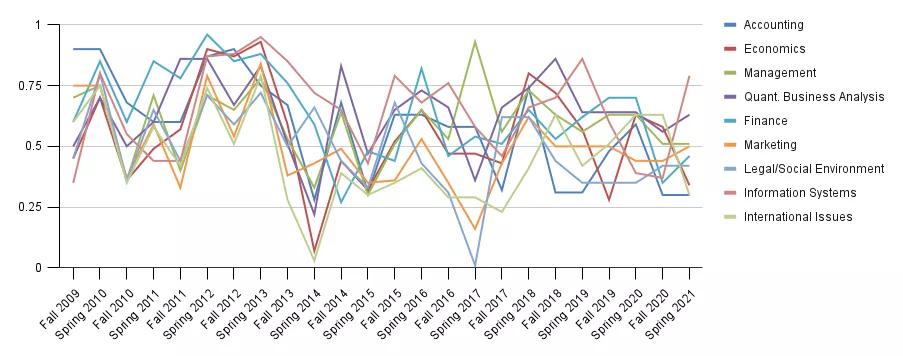

ETS Major Field Test Mean Scores for Nine Content Areas

The ETS MFT also reports student performance for each of nine content areas. As shown in the following chart, some improvement was seen during 2019-2020, with the spring 2020 semester outperforming fall 2019. Seven of the nine areas were at the 59th percentile or higher, with Information Systems (39th percentile), Legal and Social Environment (35th percentile) and Marketing (44th percentile) remaining areas of concern. Overall, in spring 2020 our students performed at the 59th percentile which was an improvement over fall 2019 (53rd percentile).

During 2020/2021, the spring 2021 semester outperformed fall 2020. Five of the nine areas showed improvement: Quantitative Business Analysis (63rd percentile), Finance (46th percentile), Marketing (50th percentile), Legal and Social Environment (42nd percentile) and Information Systems (79th percentile). We were pleased to see the improvements made with Information Systems, Legal and Social Environment and Marketing outcomes, in comparison to 2019-2020. However, Finance, Legal and Social Environment, Accounting, Economics and International Issues are areas of concern. Overall, students scored at the 46th percentile in both fall 2020 and spring 2021.

While we can’t say for certain, the scores generated during the fall 2020 and spring 2021 semesters may have been influenced by disruptions and distractions caused by COVID-19. Although we remain satisfied with the overall performance of our students on this external assessment of their business knowledge and technical skills during the past eleven-year period, we will continue to explore ways in which to improve performance.

Action to be taken: as noted above, we will continue to discuss ways of engaging international students in order to improve their performance as a group. The accounting faculty will discuss ways to improve student learning. We will continue to offer the Social Responsibility and Business Ethics elective to enhance coverage of social responsibility and business ethics. In twelve of the past twenty semesters, scores were well above the national average (65th percentile or better). The economics faculty will discuss ways to improve student learning to improve performance and knowledge retention. Finally, we will explore ways to increase coverage of international issues within existing courses, as well as to consider adding a new requirement to provide coverage of this important area.

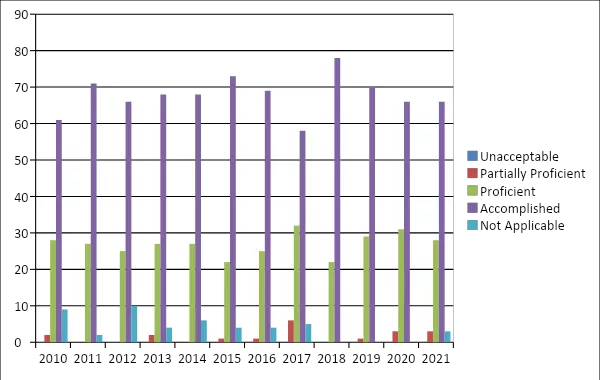

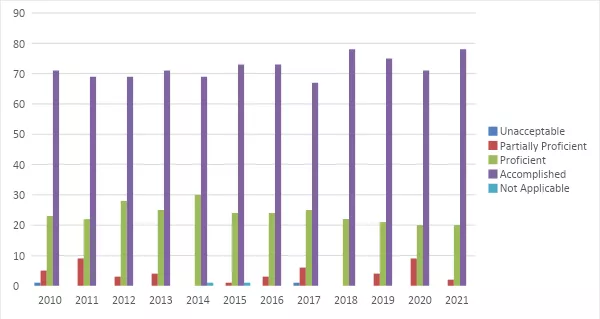

Internship Assessment (Undergraduate)

Student learning outcomes assessment related to program-specific outcomes for undergraduate students also are assessed when students complete the mandatory internship or formal work experience requirement. When a student registers for an internship, he or she must select at least three or four outcomes relevant to the type of internship, and the internship supervisor confirms that the student will be able to accomplish the outcomes. Upon completion of the internship or work experience, the COBE internship coordinator evaluates the extent to which the student accomplished each of the selected outcomes. In addition, beginning in the fall 2010 semester (including internships completed during summer 2010) the internship supervisor (the student’s employer) completes and submits an evaluation of the student’s performance on several of the College outcome areas. Having an external assessment of student performance in real work situations is tremendously appealing, as it represents an authentic assessment of student learning outcomes.

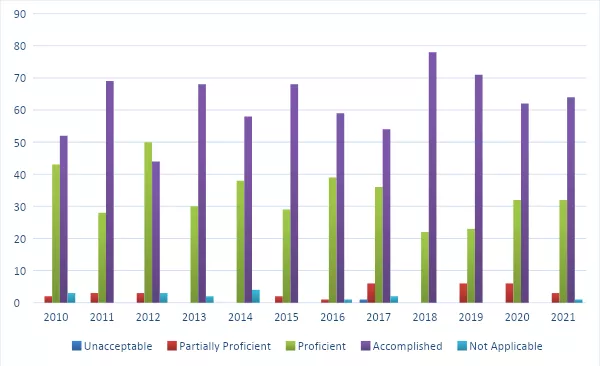

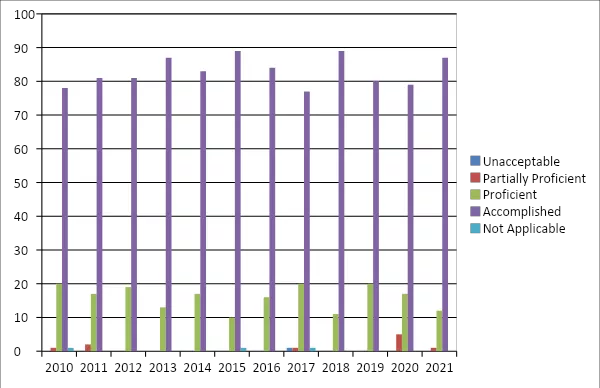

The employer survey is administered via an online survey. The employer survey is completed by the student’s internship supervisor (employer), enabling the supervisor to evaluate the intern’s performance in five of the seven student learning outcome content areas, including communication skills, leadership and teamwork, business knowledge and technical skills, ethics and analytical and quantitative skills. Results for the last eleven years 2010-2021 are provided in the following five figures. In general, we are very pleased with the strong performance displayed by our students during their internships. This reinforces the anecdotal evidence received informally from our internship employers, who have been very complimentary about our students’ preparation, ability and motivation.

Employer Assessment of Intern Performance, Communication Skills

(Percentage in Each Category)

Employer Assessment of Intern Performance, Leadership and Teamwork

(Percentage in Each Category)

Employer Assessment of Intern Performance, Business Knowledge

(Percentage in Each Category)

Employer Assessment of Intern Performance, Ethics

(Percentage in Each Category)

Employer Assessment of Intern Performance, Analytical and Quantitative Skills

(Percentage in Each Category)

We believe that this approach for assessing student learning outcomes in internships represents an innovative, best-in-class assessment that enables us to gain valuable feedback from one of our key stakeholders, employers. Participation in internships enables students to demonstrate their competency in a real-world business setting. Because the internship process is formal and structured, and because we require this feedback from all internship employers, we feel that this assessment feedback is more accurate and complete than would be a similar assessment of employers of our graduates. As we continue to employ this approach during the coming years, we will closely monitor our students’ performance and use this data to inform future curriculum design.

Eagle Investment Group Investment Performance (Undergraduate)

Eagle Investment Group (EIG) exists as a student-run investment committee with the purpose of managing a portfolio in order to develop knowledge of investing funds in the equity and fixed income markets. The Eagle Investment Group manages a combined equity and fixed income portfolio totaling approximately $2 million of the Ashland University endowment. Student learning outcomes and performance consist of:

- Construct, manage, and protect an investment portfolio, working with the Eagle Investment Group portfolio, tracking performance and reporting results.

- Understand and be able to apply portfolio theory, investment theory and policy, diversification theory and efficient market theory.

- Understand and apply various analytical techniques and tools that will assist in the construction, management and protection of the Eagle Investment Group portfolio.

- Assess investment portfolio performance using comparative analysis and commonly adopted performance standards.

In the 2019 – 2020 school year, the primary assessment of student learning outcomes was provided by the performance of the EIG group’s portfolios, including the performance relative to the major market indices. However, due to market volatility and uncertainty measuring student outcomes against a market for which they have no control seems to negate the purpose for doing so.

Through donor support, Ashland University installed 11 Bloomberg terminals for the 2020 – 2021 school year. The Bloomberg terminals provide students with news, data, research and trading tools to support and enhance student learning outcomes. These terminals are used by financial institutions and corporations all over the world to make decisions about risk, investments and markets.

Beginning with the 2020 – 2021 school year, student outcomes are measured via Bloomberg Certification. To become Bloomberg certified, students complete an eight-hour self-directed e-learning course, Bloomberg Market Concepts (BMC). With modules on Economics, Fixed Income, Equities, Currencies and using the Bloomberg Terminal, BMC courses provide an excellent assessment of the student outcomes.

- 2020 – 2021 school year = 5/6 students successfully completed the certification

- 2021 – 2022 school year = 8/8 students successfully completed the certification

Voluntary Income Tax Assistance (VITA) Program Results (Undergraduate)

Accounting majors participate in the Voluntary Income Tax Assistance (VITA) program, enabling students to apply their accounting skills to assisting low income families and students in completing their income tax returns. Using the VITA tax program exams along with the percentage of rejected/errored tax returns prepared by a student is the new assurance of learning assessment used for taxation.

Students in ACCT 308 must pass four exams in order to participate in the VITA tax program. Passing these exams on either the first or second attempt, along with a student’s error and/or reject rate of returns, constitutes where a student falls on the proficiency scale. Based on the lack of years in data, it is difficult to determine trends, but future trends are being monitored.

Even though it proved tough to finish completing tax returns when lockdown of campus occurred during the spring of 2020, this was not a factor in the spring of 2021. Taxpayers dropped off tax documents, students completed the tax returns and taxpayers picked up their final, prepared tax returns upon completion.

Dauch COBE had twenty-two student volunteers participating in the VITA program during the spring 2021 semester. These students processed 157 returns, exceeding the minimum expectations of the IRS of 50 returns. While providing a valuable service to low income families and students, these accounting students were able to apply their knowledge of the income tax filing process and provided $178,693 in federal refunds to taxpayers. All rejected returns were either from incorrectly typed social security numbers or taxpayer errors such as exclusion of needed tax documents.

Please see the below trends since the VITA Program’s inception.

2020 Tax Season/2021 Academic Spring Semester:

- 157 Returns Filed

- 6% Reject Rate

- Federal Refunds: $178,693

2019 Tax Season/2020 Academic Spring Semester:

- 58 Returns Filed

- 2% Reject Rate

- Federal Refunds: Figure not supplied by the IRS

Incoming First-Time, Full-Time Freshmen by Department and Graduation Rates (5-year) by Major Department

Information presented in this summary of Student Learning Outcomes Assessment at the Dauch College of Business and Economics at Ashland University is collected by the College in order to provide feedback to students and to inform program change as part of our strategy of continuous program improvement. This page was last updated on March 29, 2022 by Dr. Raymond Jacobs, Associate Dean and COBE Assessment Coordinator and by Dr. Ronald Mickler, Jr., Executive Director, MBA Programs.